AI-Driven Chat for Financial Education: A Safe and Educational Journey for All

The integration of Artificial Intelligence in financial education has opened new avenues for learning, making complex concepts accessible and engaging for users of all ages. This article delves into how an AI-driven chat platform can revolutionize the way we access and understand financial information, providing verified and tailored content that ensures a secure and enriching experience for everyone, from beginners to seasoned experts.

Understanding the Need for AI in Financial Education

Financial education is crucial for empowering individuals to make informed decisions about their money. However, traditional methods of learning finance often fall short due to their complexity and the diverse levels of understanding among learners. AI-driven chat platforms address these challenges by offering personalized, interactive, and real-time educational experiences. These platforms can adapt to the user's knowledge level, providing content that is both challenging and comprehensible, thereby fostering a deeper understanding of financial concepts.

Key Features of AI-Driven Financial Chat Platforms

One of the most significant advantages of AI-driven chat platforms in financial education is their ability to provide content verification. In an era where misinformation can spread rapidly, ensuring that the information users receive is accurate and up-to-date is paramount. These platforms employ rigorous verification processes to source content from reputable financial institutions, industry experts, and peer-reviewed research, thereby building trust with users.

Another critical feature is the customization of content for different age groups and knowledge levels. For children and students, the platform can offer simplified explanations and interactive elements such as quizzes and games to make learning engaging. For adults and professionals, the content can be more detailed, covering advanced topics and real-world applications. This tailored approach ensures that users at all stages of their financial journey can benefit from the platform.

Enhancing User Interaction with AI Chat

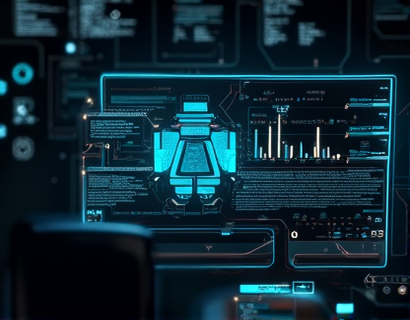

The AI chat interface is the heart of this educational experience. Users can interact with the platform in a conversational manner, asking questions and receiving immediate, relevant responses. This real-time interaction not only makes learning more engaging but also allows users to clarify doubts on the spot. The AI is programmed to understand natural language, making the conversation feel seamless and intuitive.

For instance, a beginner asking about the basics of investing might receive a step-by-step explanation, including definitions of key terms and examples of different investment options. An advanced user, on the other hand, might inquire about specific trading strategies or market trends, and the AI would provide in-depth analysis and insights based on current data.

Ensuring a Secure Learning Environment

Security is a top priority for any platform dealing with financial information. AI-driven chat platforms implement robust security measures to protect user data and ensure a safe learning environment. This includes encryption of data in transit and at rest, regular security audits, and compliance with data protection regulations such as GDPR and CCPA.

Additionally, the platform can include features to monitor and filter content to prevent the spread of misinformation or harmful material. For example, the AI can flag and review content that is flagged by users or identified as potentially misleading, ensuring that only high-quality, verified information is shared.

Content Verification and Reliability

Verification of content is a multi-layered process. The platform collaborates with financial experts, academic institutions, and regulatory bodies to source and validate information. Each piece of content undergoes a rigorous review to ensure accuracy, relevance, and timeliness. This process not only builds trust with users but also positions the platform as a reliable resource for financial education.

Users can also have confidence in the sources cited within the content. The platform can provide links to original sources, allowing users to verify the information independently. This transparency is crucial in maintaining the credibility of the platform and empowering users to make informed decisions.

Personalized Learning Paths

One of the most powerful aspects of AI-driven chat platforms is their ability to create personalized learning paths for users. By analyzing user interactions and performance, the AI can identify areas where a user may need more focus and tailor the content accordingly. This adaptive learning approach ensures that users are constantly challenged and engaged, promoting continuous learning and improvement.

For example, a user who demonstrates a strong understanding of basic investment concepts might be directed towards more advanced topics such as portfolio management or risk assessment. Conversely, a user who struggles with certain concepts can receive additional resources and practice exercises to reinforce their learning.

Supporting Financial Literacy for All Ages

Financial literacy is essential for everyone, regardless of age. Children and young adults benefit from early exposure to financial concepts, which can help them develop healthy financial habits from a young age. The AI chat platform can introduce these concepts in a fun and interactive way, using age-appropriate language and examples.

For older adults, the platform can provide in-depth information on retirement planning, estate planning, and other critical financial topics. The conversational nature of the chat interface makes these complex subjects more approachable, reducing the intimidation factor often associated with financial planning.

Real-World Applications and Case Studies

To further enhance the learning experience, the platform can incorporate real-world applications and case studies. These examples help users see the practical implications of financial concepts and strategies. For instance, a case study on a successful investment portfolio can illustrate the benefits of diversification and long-term investing.

Users can also engage with simulated trading environments where they can apply what they've learned in a risk-free setting. The AI can provide feedback on their decisions, helping them understand the consequences of different strategies and improving their decision-making skills.

Community and Support

Building a community around the AI-driven chat platform can foster a supportive learning environment. Users can connect with peers, share insights, and discuss financial topics in a moderated forum. This community aspect not only enhances the learning experience but also provides a network of support for users to turn to when they have questions or need advice.

The AI can also offer direct support, answering common questions and providing guidance on where to find additional resources. This combination of community and AI support ensures that users have multiple avenues for learning and growth.

Future Developments and Innovations

The field of AI in financial education is rapidly evolving, with ongoing advancements in natural language processing, machine learning, and data analytics. Future developments may include more sophisticated chatbots that can understand and respond to even more complex queries, as well as integration with other financial tools and platforms to provide a more comprehensive learning experience.

Additionally, the use of virtual and augmented reality could create immersive learning environments, allowing users to visualize financial concepts in a more tangible way. These innovations have the potential to make financial education even more accessible and engaging for users of all ages.

In conclusion, AI-driven chat platforms are transforming financial education by providing verified, personalized, and secure content for learners of all ages. These platforms not only make financial concepts more accessible but also empower users to make informed decisions about their financial futures. As technology continues to advance, the potential for AI to enhance financial literacy and education is vast, promising a brighter, more financially savvy future for all.